tesla tax credit 2021 colorado

I believe all Tesla models qualify for the full. Available on the Design.

Federal Tax Credits Will Soon Be Phased Out For Toyota Ev Customers In The Us Electrek

Save time and file online.

. Tesla Model X Tax Write off California. Tesla is installing Tesla Backup Switch in Xcel Energy-Colorado territory and is currently offering customers in this service territory a 500 discount on any new Powerwall plus solar installation. Posted on May 4 2021.

Chevy Bolt Chevy Bolt EUV Tesla Model 3 Kia Niro EV Nissan LEAF Hyundai Kona EV Audi e-tron Rivian R1T Porsche. This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per kilowatt hour that is in excess of 5 kilowatt hours. In the end the utility commission approved a three-year 110 million program with 5 million in incentives for low-income customers.

You may use the Departments free e-file service Revenue Online to file your state income tax. Medium duty trucks 10000. Since you asked about CO state tax the result was an entry of 5000 on line 22 of the 2017 form DR 0104 and the system added a Colorado 2017 form DR 0617 with the data listed above plus a check box for Purchased New and the 5000 amount on line 9 based on the size of the battery I think.

After that the credit phases out completely. The Federal Tax Credit will apply to the cost of the solar portion of Solar Roof as well as the cost of Powerwall. Then from October 2019 to March 2020 the credit drops to 1875.

Tesla tax credit 2021 colorado Sunday March 6 2022 Edit. Tax credits are as follows for vehicles purchased between 2021 and 2026. To qualify for the Federal Tax Credit in a particular year the eligible solar equipment must be.

On the website at the time it said there was still a 2000 Federal tax credit available. This credit includes both the 7500 main credit plus another 500 for Tesla cars with American-made batteries House version or another 2500 Senate version. State Income Tax Credits for Innovative Fuel Vehicles.

If you lease cars or trucks for your business you also qualify for the Colorado electric-vehicle tax credit under Income 69. The incentive amount is equivalent to a percentage of the eligible costs. You do not need to login to Revenue Online to File a Return.

The rate is currently set at 26 in 2022 and 22 in 2023. Beginning on January 1 2021. EV Federal Tax Credit for 2021 Tesla I purchased my Tesla Model Y in late Feb.

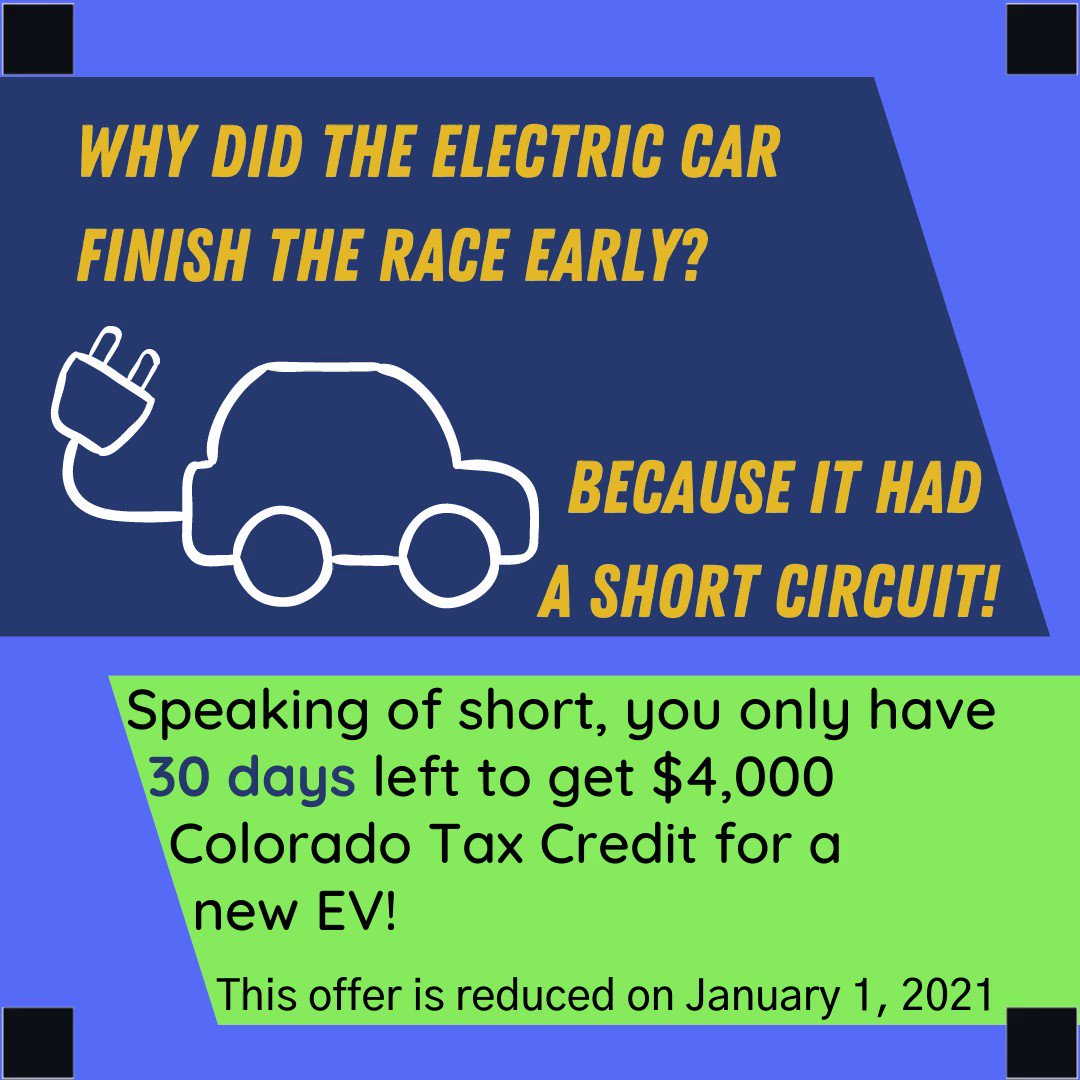

From April 2019 qualifying vehicles are only worth 3750 in tax credits. Colorados credit for new EV purchases dropped to 4000 in January and will be reduced again next year. 11th 2021 622 am PT.

California has very specific rules pertaining to depreciation and limits any Section 179 to 25000 Maximum per year. Tesla and GM are set to regain access to tax credit worth 7000 on 400000 more electric cars in the US. The renewal of an EV tax credit for Tesla provides new opportunities for growth.

The Consolidated Appropriations Act of 2021 signed December 27 2020 provided a two-year extension of the Investment Tax Credit for solar. Purchased alternative fuel vehicle. Most Tesla cars sold starting on January 1 2022 would be eligible for an 8000 or 10000 credit.

Was signed into law in 2021 and included a 5 billion program to provide funding to individual states looking to develop electric vehicle fast-charging infrastructure and establish networks of charging stations across. Contact the Colorado Department of Revenue at 3032387378. Federal tax credits of up to 7500 are still available for most EVs though Tesla met its max at the end of last year and General Motors phases out by April.

2500 tax incentive on ALL new EVs in Colorado in addition to the Federal tax credit available on many models. After you file you have the option of setting up a Login ID and Password to view your income tax account in Revenue Online. So for example if you purchase a vehicle for 100000 you can write off 25 000 as Section 179 in first year and remaining amount of 75000 in this example has to be spread over 5 year.

Latest On Tesla Ev Tax Credit February 2022 Why Texas 2 500 Electric Car Incentive Won T Apply If You Buy A Tesla The 2021 Tax Credits Will Take Tesla To The Moon Torque News. Examples of electric vehicles include. The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US.

Light duty trucks 7000. Nissan is expected to be the third manufacturer to hit the limit but. Tesla added the alert that advises California residents that they can now receive an additional 1500 incentive for purchasing an electric car.

Tax credits are available in Colorado for the purchase or lease of electric vehicles and plug-in hybrid electric vehicles. Heavy duty trucks 20000.

Ev Tax Credit Learn The Rebates Benefits Before Purchasing

2021 Chevrolet Parts Engine Chevrolet Parts Chevrolet New Cars

Ev Tax Credit Learn The Rebates Benefits Before Purchasing

Ev Tax Credit Learn The Rebates Benefits Before Purchasing

Ev Tax Credit Learn The Rebates Benefits Before Purchasing

Federal Tax Credits Will Soon Be Phased Out For Toyota Ev Customers In The Us Electrek

2021 Mustang Mach E First Drive The Electric Horseman Forbes Wheels

Evtaxcredit Twitter Search Twitter

Ev Tax Credit Learn The Rebates Benefits Before Purchasing

What Is An Ev Tax Credit Who Qualifies And What S Next

Evtaxcredit Twitter Search Twitter

Does The Rivian R1t Pickup Truck Qualify For The Federal Ev Tax Credit

Gm Ford Toyota Stellantis Ceos Want Ev Tax Credit Cap Lifted

What Is An Ev Tax Credit Who Qualifies And What S Next

Loaded 2021 Ram Trx Is The Most Expensive Half Ton Ever At 100 835 Gmc New Cars Gmc Sierra 1500

Evtaxcredit Twitter Search Twitter

What Is An Ev Tax Credit Who Qualifies And What S Next